tax incentives for electric cars australia

We know that upfront purchase price is one of the barriers hindering purchase of. Queenslands EV incentive policy is short and simple.

Electric Cars Rise To Record 54 Market Share In Norway Electric Hybrid And Low Emission Cars The Guardian

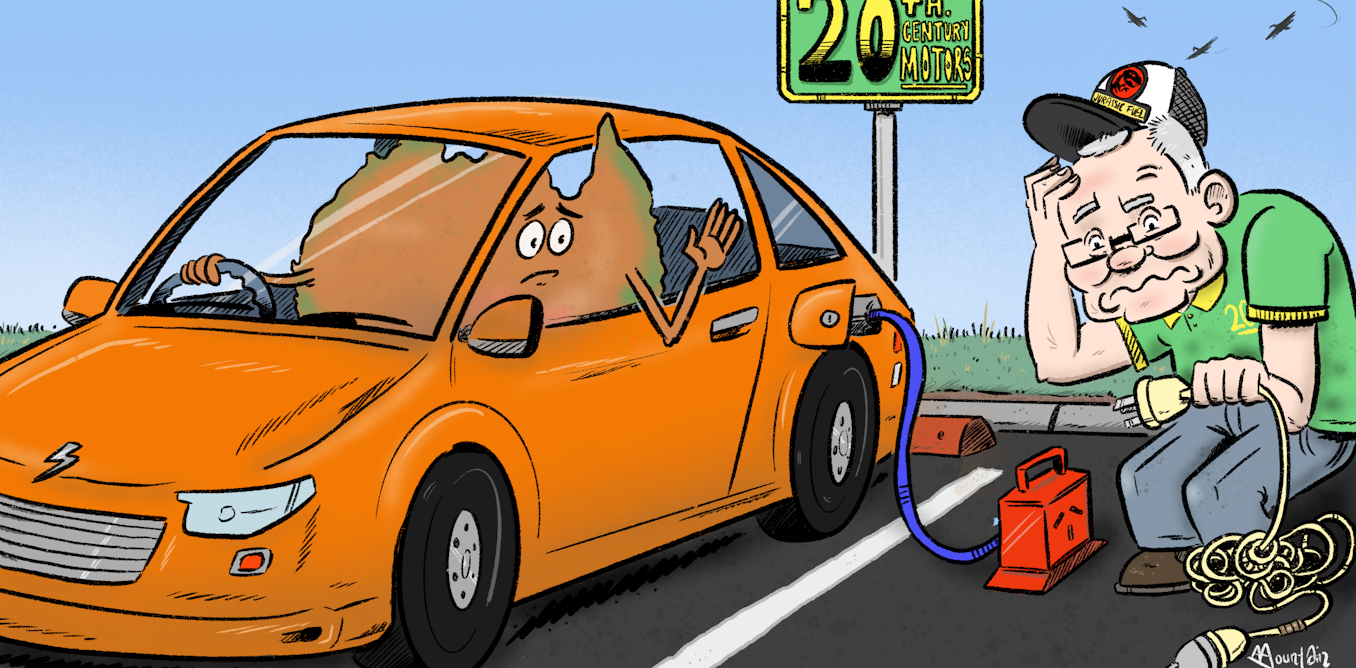

While government funding is addressing the former targeted business tax changes and incentives are needed to make the transition from combustion engine cars.

. The stamp duty for entirely electric. In the Australian Capital Territory electric car owners receive a 20 discount on annual registration costs. The LCT threshold for fuel efficient cars will increase to 79659 for the 202122 financial year.

Remember the LCT value of a car generally includes the value of any parts accessories or attachments supplied or imported at the same time as the car. Non-financial incentives such as access. Its part of a 251 million National Electric Vehicle Strategy.

The level of LCT for electric vehicles and fuel efficient cars will be relaxed to 77565 from today July 1 the start. Australian Capital Territory. Almost 75 per cent of members believe the government should be doing more to address vehicle emissions with incentives for purchases being top of the list.

The South Australian governing administration has available no electric powered auto incentives to speak of but it has determined to implement the fantastic ol 25c per km highway tax on EVs commencing from July 2022. The state gives drivers of electric plug-in cars a 100 discount on their annual registration. Government Tax Incentives for Electric and Hybrid Cars New South Wales.

Vehicles provided by employers to employees for private use are subject to fringe benefits tax at a rate of 47 per cent while six of the 11 EVs currently under the LCT threshold for fuel-efficient vehicles 79659 are subject to the five per cent import tariff. New EVs are exempt from stamp duty about 1350 for a 45000 car New South Wales. QLD Incentives Exemptions Electric and hybrid vehicles pay reduced stamp duty.

One of the incentives offered by the NSW Government is a cash rebate of 3000 on 25000 eligible vehicles. The NSW Electric Vehicle Strategy outlines a number of incentives to encourage the purchase of battery electric vehicles BEVs and hydrogen fuel cell electric vehicles FCEVs in NSW. Government Incentives in Australia Europe USA Canada China India United Kingdom - whats on offer and why tax payer incentives in the first place.

Tasmania A two-year waiver on stamp duty has been introduced for new and second-hand EVs which is expected to save EV drivers around 2000 in costs. President Bidens EV tax credit builds on top of the existing federal EV incentive. Electric cars available in Australia in 2021 This is recognised by RAC members with nearly 60 per cent saying high cost is the main barrier to buying an electric or hybrid vehicle.

2 per 100 up to 100000 dutiable value and 4 per 100 value thereafter compared to up to 6 per 100 for more polluting vehicles. Stamp duty waiver for EVs under 78000 pencilled to start September 1 COVID dependent all other EVs and plug-in hybrids from July 1 2027 or when EVs make up at least 30 per. Luxury car tax LCT.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. Electric Vehicle Incentives Australia. A 3000 subsidy is available for 7000 new battery electric and hydrogen fuel cell vehicles valued below 68750 including GST registered in South Australia from 28 October 2021.

The level of luxury car tax imposed on electric vehicle and fuel efficient cars in Australia has been quietly relaxed the first time that EVs and fuel efficient cars have been given a bigger break than their fuel guzzling competitors in more than a decade. There are no grants or subsidies available currently but drivers pay 2 per 100 in value up to 100000 and 4. Luxury Vehicle Owners Missing Out On Important Australian Electric Car Tax Rebate.

Subsidies are limited to one per individual person residing in South Australia and two per business located in South Australia. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. These include tax rebates infrastructure subsidies stamp duty exemptions and registration discounts.

8 rows The only electric car incentives in Australia at a federal level is a higher luxury car tax. According to Australias Electric Vehicle Council key incentives toward broader EV ownership can include financial subsidies to help bridge the gap between the cost of an EV and internal combustion engine ICE vehicle. The first 25000 EVs.

The South Australian government has offered no electric car incentives to speak of but it has decided to implement the good ol 25c per km road tax on EVs starting from July 2022. Planning on buying an EV post-September 1 for not one cent over 68750 including GST. While luxurious EV options like the Audi e-tron Jaguar I-PACE or Porsche Taycan will still be eligible for that.

Read more at Monash Lens. You pay less stamp duty. The impediments for road transport emissions reductions in Australia include a lack of EV charging infrastructure and EV affordability.

From 1 July 2021 the LCT threshold will increase to 69152. Bad news for Victorian EV.

Tracking Electric Vehicles 2020 Analysis Iea

Tax Credit For Electric Cars Tax Credits Irs Taxes Electricity

Sweden S Uniti Points The Way To Affordable Practical Electric Cars

Top Economists Call For Measures To Speed The Switch To Electric Cars

Electric Vehicles The Revolution Is Finally Here Financial Times

Could Electric Cars Be The Norm In Just A Few Decades Shell Global

Thinking Of Buying An Electric Car Here S What You Need To Know About Models Costs And Rebates Electric Vehicles The Guardian

Best Electric Cars And Evs For 2022 Roadshow

Here S Every Electric Vehicle That Currently Qualifies For The Us Federal Tax Credit Electrek